Stepping into the high-stakes world of mergers and acquisitions is an ambitious goal for many finance professionals. It’s a field known for its rapid pace, complex deal structures, and the significant impact it has on the global economy. As a result, the competition for roles within M&A is incredibly fierce, attracting top talent from across universities and industries. Your curriculum vitae isn’t just a document; it’s your crucial first impression, a concise narrative of your skills, achievements, and potential.

To truly stand out in this demanding landscape, you need a CV that doesn’t just list your experiences but powerfully articulates your value. A generic approach simply won’t suffice when you’re vying for positions that require specialized knowledge and a proven track record. This article will guide you through the essential elements of a compelling mergers and acquisitions CV template, helping you craft a document that resonates with recruiters and opens doors to your dream M&A career.

Crafting Your M&A CV: Key Sections and Content

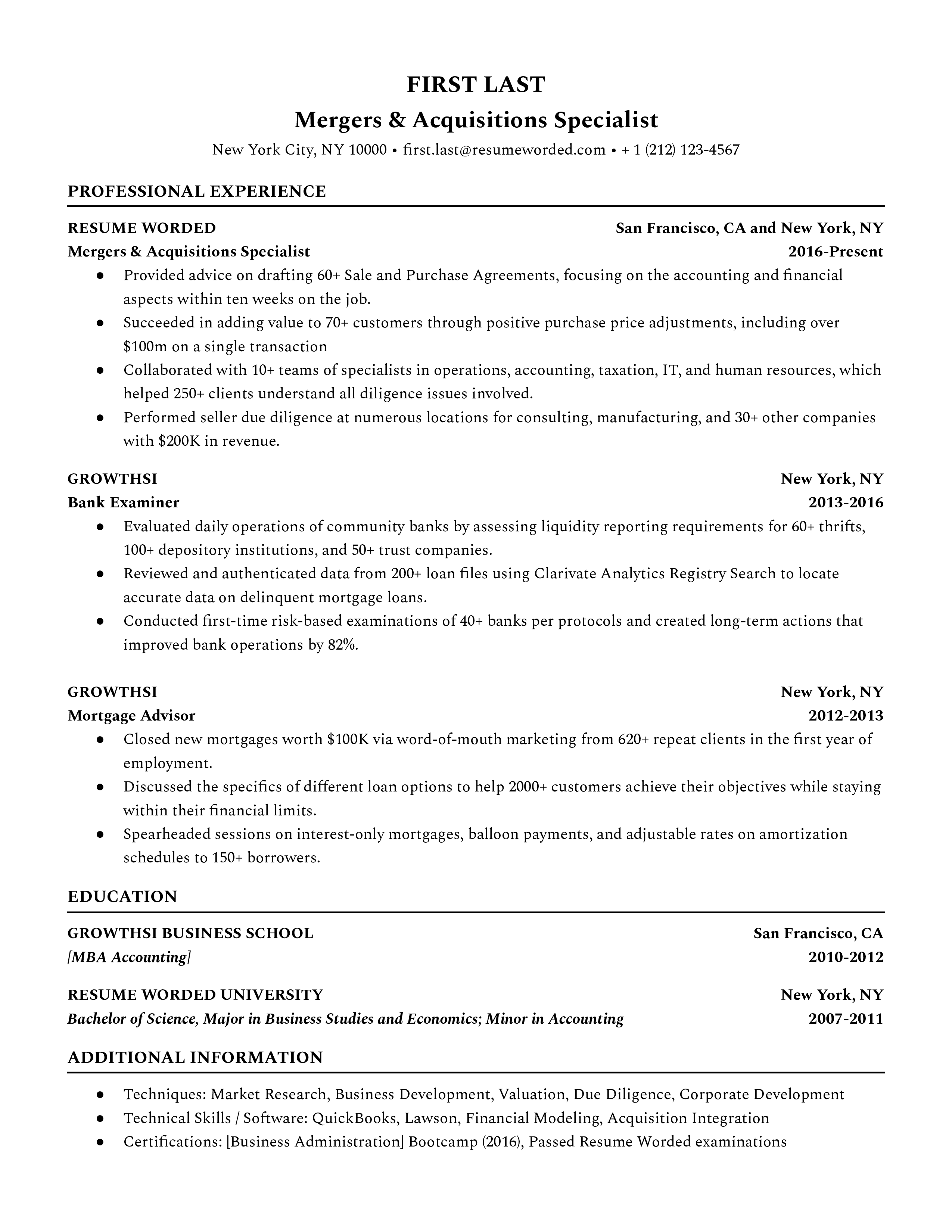

When constructing your M&A CV, think of it as a strategic document designed to showcase your analytical prowess, deal-making capabilities, and financial acumen. Unlike a standard finance CV, an M&A-focused one demands a particular emphasis on quantifiable achievements and direct relevance to transaction advisory or execution. Every section should contribute to building a cohesive narrative that highlights why you are an ideal candidate for M&A roles, whether you’re an experienced professional or a recent graduate eager to break in.

The Education Section: More Than Just Grades

Your educational background provides the foundational knowledge crucial for M&A. Don’t just list your degree; emphasize relevant coursework that aligns with corporate finance, valuation, accounting, and economics. Highlight any academic achievements such as dean’s list, scholarships, or honors. Participation in finance-related clubs, investment challenges, or case competitions, especially those focused on M&A scenarios, can also demonstrate your proactive engagement and passion for the field. If you’ve completed any specific M&A certifications or executive education programs, this is the place to feature them prominently.

The work experience section is where your M&A CV truly shines. Here, you need to move beyond mere job descriptions and present yourself as a problem-solver and value-creator. Focus on specific deals or projects you’ve been involved in, detailing your role, the industries, and the financial impact. Use strong action verbs and quantify your achievements whenever possible. For instance, instead of saying “Assisted with due diligence,” articulate “Conducted financial due diligence on a $50M tech acquisition, identifying key risks that led to a 5% price adjustment.” This level of detail makes your contributions tangible and impactful.

- Quantifiable achievements and impact of your work

- Specific deal involvement, including transaction size, industry, and your precise role

- Relevant skills utilized, such as financial modeling, valuation, market research, and due diligence

- Your responsibilities in project management, team collaboration, or client interaction

Finally, a dedicated skills section is vital. Beyond listing technical proficiencies like financial modeling (DCF, LBO, merger models), valuation techniques, and software (Excel, Bloomberg, Capital IQ, PowerPoint), include soft skills that are highly valued in M&A. These include strong communication, negotiation, analytical thinking, problem-solving, and attention to detail. Tailor this section to reflect the skills mentioned in the job descriptions you’re applying for, ensuring maximum relevance.

Tailoring Your Mergers and Acquisitions CV Template for Impact

The M&A job market is incredibly competitive, and a “one-size-fits-all” approach to your CV will likely result in your application being overlooked. To truly make an impact, you must tailor your mergers and acquisitions CV template for each specific opportunity. This isn’t about fabricating experience, but about strategically highlighting the most relevant aspects of your background that align with the requirements and preferences of the particular firm and role you’re targeting. Research the company’s recent deals, culture, and the specific responsibilities outlined in the job description.

In today’s recruitment landscape, Applicant Tracking Systems (ATS) are often the first gatekeepers. These systems scan CVs for keywords to determine their relevance before a human ever sees them. Incorporate industry-specific jargon and keywords directly from the job description into your CV, especially in your work experience and skills sections. Think about terms like “synergy identification,” “deal structuring,” “post-merger integration,” “capital markets,” or “leveraged buyouts.” This strategic keyword placement increases the likelihood of your CV passing the initial screening and reaching a recruiter’s desk.

Beyond keywords, your CV should tell a compelling story. Each bullet point under your experience should contribute to a narrative of growth, capability, and impact. Don’t just list tasks; explain the “why” and “how” behind your actions and the positive outcomes. For example, instead of “Analyzed financial statements,” consider “Performed in-depth financial statement analysis for acquisition targets, leading to the identification of cost synergies valued at $X million.” This approach demonstrates not just what you did, but the value you brought to the table.

- Highlighting your unique value proposition that aligns with the firm’s strategic goals.

- Demonstrating a clear progression in your responsibilities and expertise over time.

- Connecting your past experiences directly to the specific needs and challenges of the target firm.

Finally, meticulous proofreading and professional presentation are non-negotiable. A single typo or formatting error can undermine the credibility of an otherwise strong application. Ensure your CV is clean, concise, and easy to read. Use a consistent format, appropriate margins, and a professional font. Aim for a maximum of two pages for most roles, with seasoned professionals sometimes extending to three if their deal sheets warrant it. Clarity and conciseness are paramount; every word should earn its place.

Navigating the competitive waters of mergers and acquisitions requires not just skill and experience, but also the ability to present yourself effectively. Your CV is your marketing tool, a distilled representation of your professional journey and future potential. By thoughtfully structuring each section, meticulously detailing your contributions, and customizing your content for every application, you significantly enhance your chances of securing an interview.

Crafting a powerful CV is an ongoing process of refinement and strategic thinking. It’s about showcasing your analytical prowess, your transactional experience, and your dedication to the complex world of corporate finance. With a well-executed CV, you’re not just applying for a job; you’re making a strong case for why you are the ideal addition to an M&A team, ready to contribute to impactful deals and drive significant value.